1

2

3

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

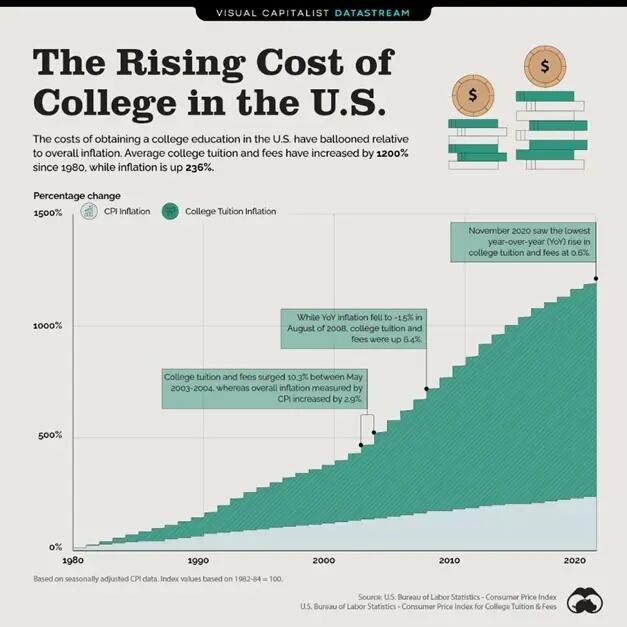

The vicious cycle is obvious. So why not stop raising the loan maximums? Because higher education is a $200+ billion industry. Even in the public university system, an entrenched bureaucracy is getting wealthy off high tuition. The corrupt cycle looks like this: university administrators and faculty unions donate to left-wing super PACs. In return, they ask for increased student loan limits and more federal grants under the banner of increasing “affordability” for students. Universities then raise tuition and funnel the new money into raises, administrative expansion, and campus construction projects. Then, faculty members continue indoctrinating students to vote for far-left candidates, and the racket continues.

A Forbes article stated the following:

“Between 1976 and 2018, full-time administrators and other professionals employed by those institutions increased by 164% and 452%, respectively. Meanwhile, the number of full-time faculty employed at colleges and universities in the U.S. increased by only 92%, marginally outpacing student enrollment which grew by 78%.”

University administrators are not using the increased tuition revenue to create smaller class sizes or improve student’s education. They are inflating the bureaucracy to create a colossal social justice organization.

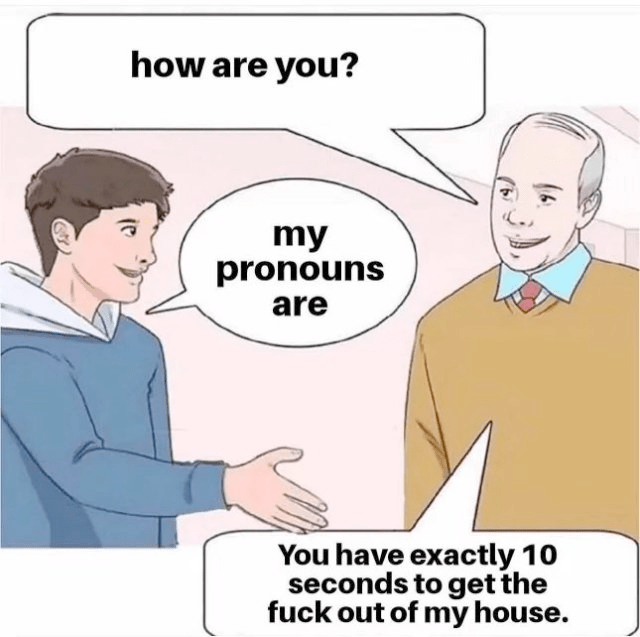

Graduation now depends on ideological coursework; every student in the California State University system’s 23 campuses must take a class in ethnic studies or social justice. The point is twofold: indoctrinate students in radical leftist ideology and create education jobs for graduates with useless degrees like San Francisco State’s Social Justice Education program. It’s a pyramid scheme designed to enrich the academic elite and cement progressive dogma in the young professional class.

Universities are so effective at converting students into activists that the education system can’t even afford to employ them all. We have begun to see the private sector’s culture shift to placate the radical employees coming out of colleges. So many young adults have fallen under the spell of left-wing cultural ideology that an entirely new industry has appeared out of thin air. “Diversity, Equity, and Inclusion” training and consulting is now a $15 billion industry. Firms now feel obligated to create mandatory training programs under pressure from young employees. These consulting fees are nothing but tributes to activists in exchange for a “Get-Out-Of-Jail-Free” card in case an employee says something in public contrary to leftist social doctrine. While universities have succeeded at getting rich by indoctrinating students and poisoning our culture, they’ve also buried an entire generation in debt.

FWIW, Covid was a tool by DC, not an emergency.

Starting Friday, federal student loans under the SAVE (“Saving on a Valuable Education”) repayment plan will begin accruing interest again. This affects approximately 7.7 million to 8 million borrowers, said federal stats — interest had been paused during ongoing legal action.

Advocacy group estimates suggest this will cost the typical borrower around $3,500 per year in interest, which breaks down to about $300 extra per month on average, according to the Education Department.

Courts invalidated key provisions of the SAVE program, including the zero‑interest feature. A court injunction requires loan servicers to begin charging interest again starting Friday.

The U.S. federal government suspended interest on student loans—and paused payments and collections—primarily due to the COVID‑19 emergency.

How do you like that gender studies degree now?

The Supreme Court said no to this once. He’s behind as Trump is gaining in the 18-34 age category, so give away free stuff at election time. It’s a tried and true, but weary strategy by the left. It’s called Santa Claus…giving free stuff. We the taxpayers will pick up the cost because someone has to pay. How about those who took out the loans?

Excerpt:

The Biden administration announced Wednesday that it would forgive an additional $4.8 billion in student loan debt for 80,300 borrowers, bringing the total that taxpayer burden to $132 billion.

“I won’t back down from using every tool at our disposal to get student loan borrowers the relief they need to reach their dreams,” President Joe Biden said in a Dec. 6 statement, in which he made clear that his administration is undeterred by the recent Supreme Court decision to block a wide-ranging initiative to cancel up to $20,000 in debt per student.

I’ve had 2 of them. I fished with guys who had a bigger loan on their boat than their mortgage. I paid for mine on a credit card I recall to get frequent flyer points.

Everything you hear about owning a boat is pretty much true. Best/Worst day, hole in the water where you dump your money and so forth.

It was fun, but I didn’t see how those guys could afford it, but here you go.

Instead of leaving the country in better shape as every generation until now has done, debt is weighing on us like a herd of elephants. The taxpayers, likely the next generation will be taxed ad infinitum.