THE CAUSE – VIA USA TODAY

Recently elected President Francois Hollande’s Socialist government introduced France’s 2013 budget with steep tax increases on the rich that include a 75% tax rate on those earning more than $1.28 million for two years and a new 45% rate for revenues of more than $193,000. Higher taxes on businesses are proposed as well.

THE RESULT

“In the north, we are hearing that more and more people are preparing to leave the country,” said Sebastien Huyghe, a conservative UMP lawmaker. “This autumn, a number of people may make their arrangements.

“The 75% tax will not fill the country’s coffers; instead, it sends a strong signal that will both scare away those who have the means to create jobs, and prevent others from coming and investing in France,” he said.

Economists and analysts say the super-tax is more symbolic than effective, saying it would affect only 2,000 to 3,000 French households while adding little to state revenue.

“From a strictly budgetary and economic point of view, the impact will be marginal, but the Socialists expect a political effect, and they are right,” said Thierry Pech, editor-in-chief of Alternative Économiques monthly magazine. “There is a deep resentment (by the public) against the ultra-rich, one that could feed populism.”

Many French say these super-rich must contribute more, and those seeking tax exile betray the very country that gave them the savoir-faire that led to their international success, a sort of French version of the “You didn’t build that” claim that President Obama leveled against successful businesspeople in America.

“Has (Arnault) thought about all the help he has received from French investors and from the French state itself to make it where he is now?” asks French taxpayer Olivier Weber in Paris.

Last year, 16 business tycoons and other holders of French fortunes wrote an open letter in the French weekly magazine Le Nouvel Observateur with the title “Tax us!”, saying that after benefiting from the “French model,” they were willing to pay more in times of crisis. But that was before a super-tax.

Many of them have changed their minds, such as Jean-Paul Agon, the chief executive of L’Oréal, the biggest cosmetics company in the world.

“If there is such a new tax rule, it’s going to be very, very difficult to attract talent to work in France, almost impossible at a certain level,” he told The Financial Times.

Even Stéphane Richard, CEO of telecom company Orange , who is close to the Socialist party, is worried about the “accumulation” of taxes and the impact on the French economy.

“I’m worried that we start by taxing the rich, and that’s it,” he told French daily Le Monde. “It’s one thing to call on economic patriotism, it’s another to organize a looting (of the rich) that will turn on the tax exile machine.”

Some French shrug their shoulders with typical Gallic distaste

“It’s normal to pay your taxes — it’s important — it means you belong to a community,” said Christine Templier, 38.

IS THE USA GOING DOWN THIS PATH?

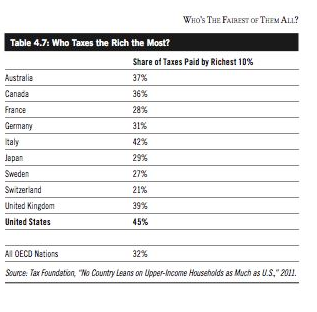

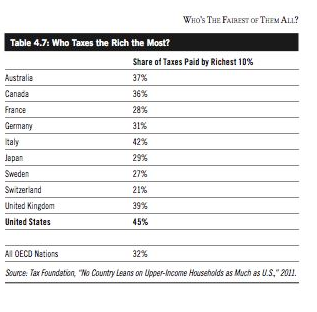

Share the wealth has been the mantra of the current government. Current policies emulate France, Greece and the PIIGS. Based on our tax system, we certainly seem to be headed in the direction of not having enough taxpayers to pay for the entitlements.

It is said that the 1% need to pay more. In fact, if you confiscated 100% of their wealth, it wouldn’t make a dent in the deficit. It causes division and class warfare. It clearly defies the history of success where “a rising tide raises all boats”.

SO WHAT IS THE ANSWER?

Besides the obvious of spending less, which congress does not have the ability on either side to do, grow the base of taxpayers and more revenue will come in. JFK and Reagan (and other Presidents) proved this so we have history to support this. In fact, the largest year of tax revenue ever by the government was 2007. There are far more complex economic theories, but increase a tax base who are not afraid to spend more, and tax revenue will rise.

CONCLUSION

I don’t think Zuckerberg, Gates and Buffet will leave America if they raise taxes, but many are leaving California (at 2000 per week). If you look at history, we can do more by having an economy that is growing for everyone. By not singling out a specific group, we get the rising tide and an economy shift with more jobs and more tax revenue.

As for the rich French, many are now in Switzerland.

Maybe there will be a lesson in here for them and they can get their tax base back.