If you do everything you can to make it difficult to work, it will go somewhere else. It’s like space that abhors a vacuum. As you’ll read, it’s not just Germany

Automotive giant Stellantis is expanding its U.S. operations. Any sign of an investment turnaround in Germany, which Chancellor Friedrich Merz touted just weeks ago, is nowhere to be seen.

Investment Freeze at Stellantis – in Germany at Least

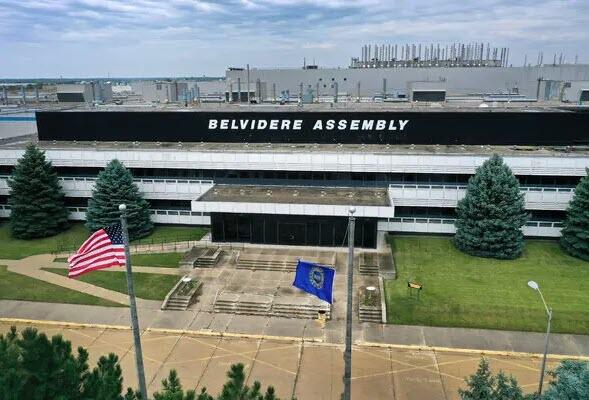

The European carmaker, home to brands like Opel, Peugeot, and Citroën, is turning away from its European sites. On Monday, Stellantis announced it will invest $13 billion in the U.S. over the next four years, increasing American production by 50%. The expansion will create 5,000 new jobs across plants in Illinois, Ohio, Michigan, and Indiana.

The concrete impact on German production remains unclear. Stellantis offered no comments on potential layoffs, but it’s safe to assume significant parts of production will shift to the U.S. in the coming years. High energy costs and U.S. tariffs likely influenced this decision.

CEO Antonio Filosa emphasized that this largest investment in company history will create American jobs and systematically expand U.S. manufacturing. The U.S. will now be Stellantis’ top priority.

Germany Avoided

Stellantis’ damning verdict, especially for its German production sites, is just the tip of the iceberg in an accelerated capital flight from Germany. Major German automakers are increasingly relocating production abroad: BMW to Debrecen, Hungary—and Mercedes-Benz to Kecskemét, Hungary.

Industry is abandoning Germany. The manufacture of energy-intensive products, electrical engineering, machinery, and raw materials is no longer profitable under current conditions. It seems almost comical—if it weren’t so tragic—when Minister of Economic Affairs Katherina Reiche, noting Germany’s lack of competitiveness, forms a task force to develop strategies out of the crisis.

A quick ten-second search on „Grok“ could illuminate the issues—the problems are already well known.

The Green Deal Remains the Golden Calf

Meanwhile, Chancellor Merz made clear during the EU summit that all options are being considered—except tackling the root cause: the grotesque European climate policy that largely triggered this industrial collapse.

The reflexive defense of Brussels’ climate consensus under all circumstances shows Berlin fully understands what’s driving Germany’s economic collapse. Yet the government pins its last hope on a massive debt package that will pour roughly €50 billion in additional annual spending across the country. Finance Minister Lars Klingbeil expressed hope at the UN summit that private industry will invest now that the state is taking the lead.

The response should be: far from it, Mr. Minister. You misread economic reality. The fact that U.S. chipmaker Intel rejected a €10 billion subsidy to set up in Magdeburg shows the problems run much deeper—and cannot be fixed with handouts. Keynesian “voodoo economics” has reached its limits. Germany is on sale; industrial investors have already passed judgment.

Rust Belt on the Horizon

Political ignorance will cost dearly. Losing the industrial base triggers massive societal distortions. Recent industrial history provides several illustrative examples: the decline of the English textile industry, Argentina’s machinery sector—or closer to home, the collapse of coal and steel in the Ruhr.

Left behind are true Rust Belts, as in the U.S. Detroit, once America’s wealthiest city, fell as its auto industry collapsed, allowing other hubs, particularly in Japan and China, to rise.

The industrial foundation is key to understanding economy and prosperity. Statistically, one industrial job creates four or five additional jobs in supply chains, services, and consumption. Industrial jobs are typically above-average paying; losing them sparks a chain reaction of social and economic decay.

UK as a Case Study

The U.K. provides a textbook case. Once at the peak of global industrial output, the empire financed massive overseas infrastructure projects. Imperial overstretch followed, investments collapsed, and industrial decline set in. Other industrial centers, notably the U.S., rose.

Left behind was the City of London: a global financial hub surrounded by a powerful insurance architecture across former empire trade routes. A dual society emerged: the finance center exercising global influence, and “Little Britain,” trapped in poverty. Could Germany face the same fate, minus colonial flows of finance and power?

Time Window Closing

Currently, around 5.4 million Germans still work in industry—autos, machinery, electrical engineering. Since 2018, their number has fallen by roughly 250,000. Industrial output has dropped by an average of 23%, representing at least €35 billion in lost annual value creation.

There is still time to counteract—so far, mostly lower-value production has been outsourced or shut. There is still time to preserve both Germany’s industrial and social foundations in urban regions.

Yet deindustrialization now shows on the municipal level. Regions dependent on autos are seeing local finances collapse amid the catastrophe facing German carmakers. Too much responsibility is centralized; now funds for schools, kindergartens, cultural institutions, and hospitals are missing. Cities like Stuttgart and Wolfsburg, once automotive strongholds, are fiscally drained.

With industry also disappears private patronage. Germany is losing its millionaires and economically successful elite faster than ever. This year, at least 400 wealthy individuals will likely leave, removing over €2 billion in private capital.

Last year, €64.5 billion in corporate direct investment was shifted abroad—much of it to the U.S. This is capital translating directly into economic activity, not stock market circulation.

History teaches: if elites lose faith in a society or business location, social crisis inevitably grows from that vacuum.